Recommended workflow

You’ve explored how Midaz works—from its core entities to its architecture, logic and security. Now it’s time to put that knowledge into action.

Whether you're launching a fintech product or modernizing internal systems, structured workflows are key to translating Midaz's concepts into real-world financial operations. Product managers and engineers play a central role in this process—especially in the Community Model, where core features are self-hosted and plugin-free.

Think of each transaction as a ledger event. With that mindset, the workflows outlined here will help you apply everything you’ve learned—ensuring clarity, traceability, and auditability right from the start.

Setting up and managing Ledgers

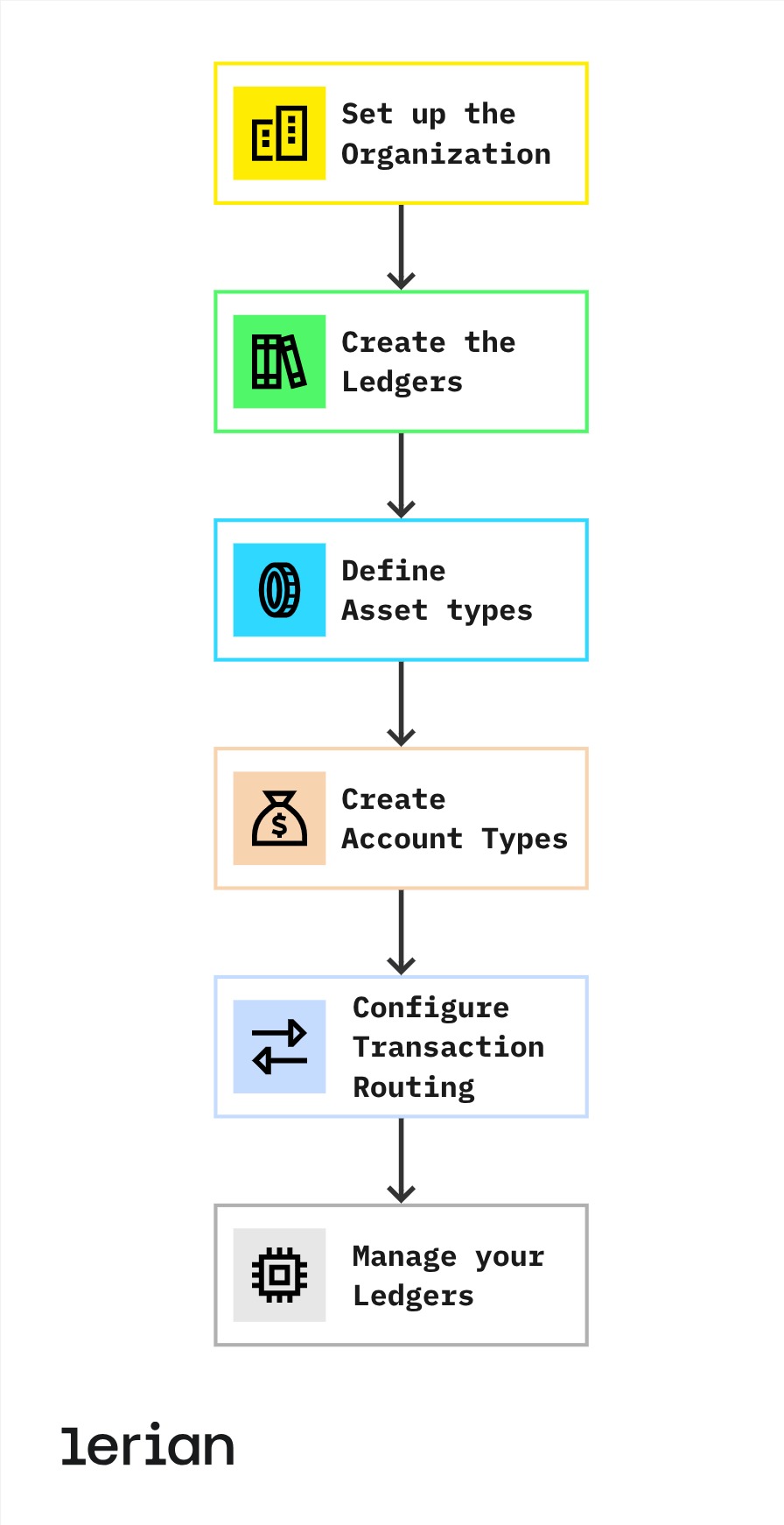

When onboarding to Midaz, follow these key steps to establish a solid foundation for your financial infrastructure:

Figure 1. Workflow for setting up and managing ledgers.

Step 1: Set up the Organization

Your organization in Midaz represents your bank or business entity. If it hasn’t been created yet, set it up via the Console or API. Ensure that all core details, such as legal name and identifiers, are accurate, as this context will underpin all ledger operations.

Step 2: Create the Ledgers

Create a Ledger under your organization to hold financial records. It’s common to start with a primary ledger for all customer-facing operations (e.g., “Main Banking Ledger”). Initially, it will contain no accounts, but serves as the base layer for all financial activity.

Step 3: Define Asset types

Register the assets your ledger will support—this can include currencies (e.g., BRL, USD), points, or even crypto tokens. These assets will be used throughout your account and transaction configuration. Assets can be extended as your product portfolio evolves.

Step 4: Create Account Types

If you plan to enforce account classification rules, define your Account Types. These represent structured categories (e.g., user_wallet, treasury, revenue) that can later be referenced during account creation or transaction validation.

NoteAccount Types are optional by default, but when enabled, they become required during account creation to ensure classification consistency across your ledger.

Each Account Type has a keyValue, which must be unique and alphanumeric (dashes and underscores allowed). These identifiers will be used in validation flows and transaction routes.

Step 5: Configure Transaction Routing

Use Operation Routes and Transaction Routes to define and enforce structured validation for your transactions.

- Start by creating the Operation Routes, which validate each leg of the transaction individually (e.g., the debit must come from an account of type

user_wallet, and the credit must go to the alias@external/BRL). - Then, create the Transaction Route, combining the individual operation routes into a complete flow (e.g., a cashout transaction with specific debit and credit validations).

ImportantOnce routing is configured and validation is enabled on the ledger, all submitted transactions must conform to the defined routing structure—otherwise, they will be rejected.

The

routefield in the transaction payload must include the ID of the Transaction Route you created.

Step 6: Manage your Ledgers

Keep your ledgers clean and scalable with the following best practices:

- Use Midaz’s RBAC system to assign permissions and control access per ledger.

- Plan for separate ledgers when needed (e.g., “Testing”, “Internal”, “Multi-entity”), and document ownership.

- Periodically review and reconcile ledger data, especially when integrating with external settlement systems.

- Midaz enforces double-entry logic, so every movement is fully traceable—no manual balance changes.

Configuring Accounts, Portfolios, and Segments

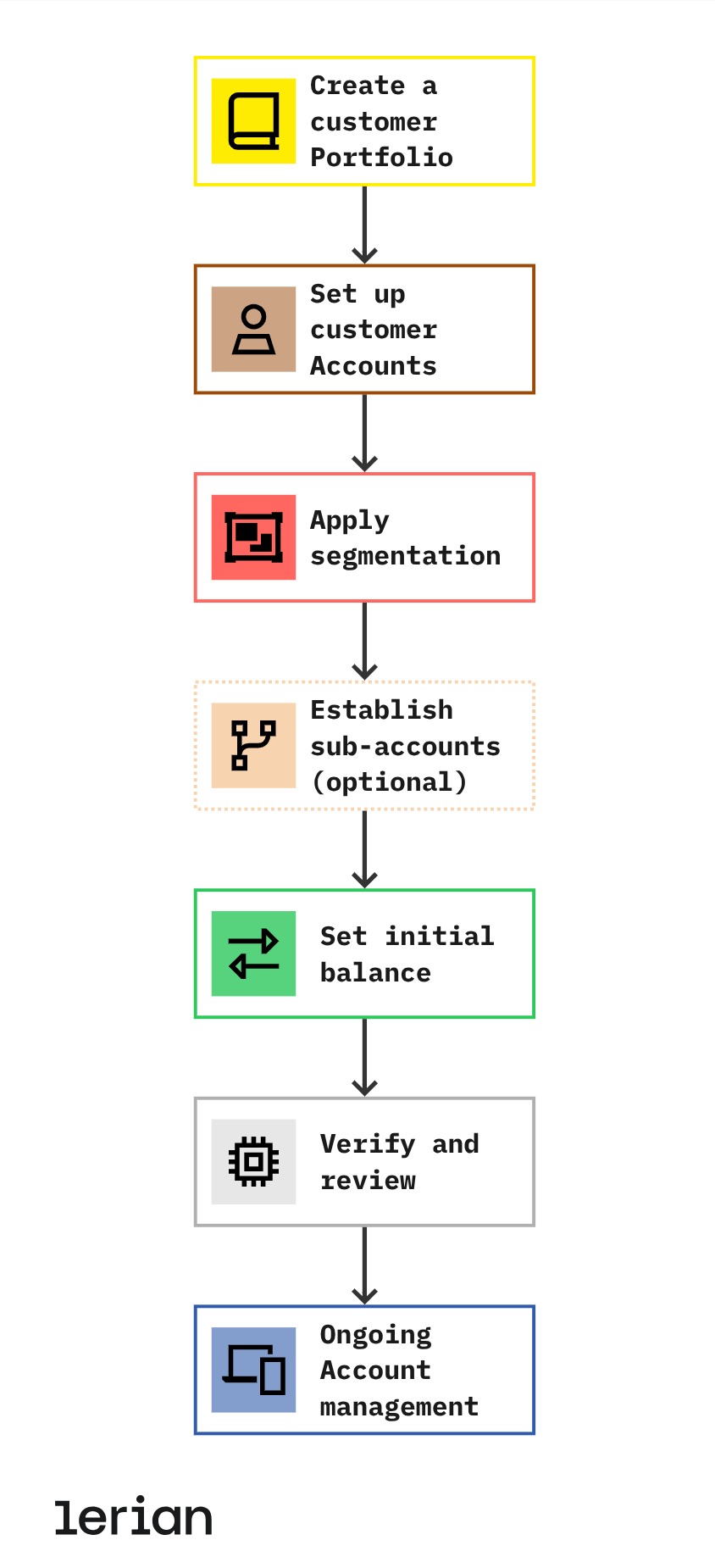

This section helps you structure customer data and product entitlements in Midaz.

Figure 2. Workflow for configuring Accounts, Portfolios, and Segments.

Step 1: Create a customer Portfolio

Start by creating a Portfolio for each new customer. Portfolios act as the logical containers for accounts. Link each portfolio to your CRM or internal system via metadata (e.g., Entity ID).

Step 2: Set up customer Accounts

Each financial product or asset the customer holds becomes a separate Account under their portfolio.

- A checking account in BRL and a savings account in USD are separate accounts.

- If Account Types are enabled, the

typefield becomes mandatory and must match one of the pre-registered values. - Use account aliases to simplify downstream operations.

TipAccount Types help standardize account categorization across your entire ecosystem—improving routing, reporting, and integrations.

Step 3: Apply segmentation

Use Segments to categorize portfolios or accounts (e.g., standard, vip, enterprise). These tags allow for dynamic logic (e.g., fee exemptions, tiered interest) based on customer segmentation.

Step 4: Establish sub-accounts (optional)

For organizations or specialized cases, you can configure sub-accounts. Use clear naming conventions to maintain traceability (e.g., "Acme USD - Payroll").

Step 5: Set the initial balance

Use the Transactions API to inject the opening balance. This ensures traceability and double-entry compliance:

- Debit the funding source.

- Credit the new account.

- Do not manually update balances—Midaz tracks every value via transactions.

Step 6: Verify and review

Before proceeding with operations:

- Confirm accounts were created with the correct assets and types.

- Validate account balances.

- Check if segmentation has been applied.

- Confirm setup via API or the Console.

Step 7: Ongoing Account management

Maintain system integrity by managing lifecycle operations via API or Console:

- Update account details as needed.

- Close accounts only once the balance reaches zero.

- Reclassify portfolios/accounts if segmentation changes.

Implementing double-entry transaction management

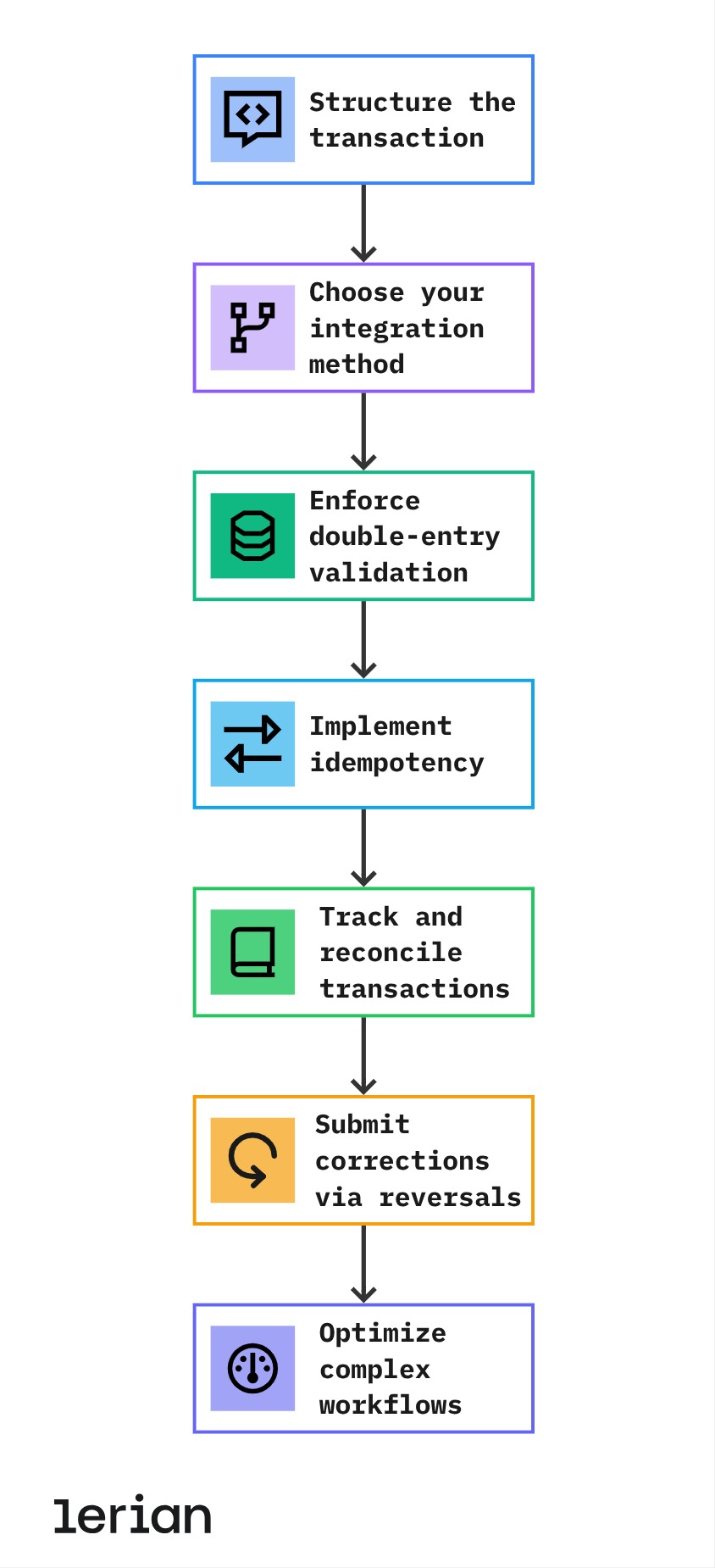

Midaz guarantees ledger integrity through strict enforcement of double-entry logic. Every transaction must contain at least one debit and one credit operation.

Figure 3. Workflow for implementing double-entry transaction management

Step 1: Structure the transaction

Begin by structuring your Transaction object:

- Once your Transaction Route is configured, insert its ID into the

routefield of your transaction payload. - Define the source and destination accounts, including asset and value details.

- Add descriptive metadata to ensure traceability and clarity.

Step 2: Choose your integration method

You can define transactions via:

- Transaction DSL (Gold Language) – a human-readable syntax for quick prototyping.

- Transactions API – for full control and programmatic execution.

Both approaches are fully supported and produce identical ledger entries.

Step 3: Enforce double-entry validation

Midaz automatically verifies that the sum of credits matches the sum of debits. Mismatches or structural violations will reject the transaction at submission.

Step 4: Implement idempotency

Use idempotency keys to prevent duplicates from network retries. Midaz will recognize repeated keys and avoid duplicate processing.

Step 5: Track and reconcile transactions

Use built-in tools to:

- Track submitted and posted transactions.

- Audit metadata and timestamps.

- Reconcile transaction batches for compliance.

Step 6: Submit corrections via reversals

Rather than editing or deleting transactions, submit corrective entries. Every reversal is linked to its original via the transaction metadata for full traceability.

Step 7: Optimize complex workflows

Use multi-operation transactions to:

- Process interest accruals.

- Execute batched payouts.

- Handle conditional flows with routing logic.

Midaz ensures atomicity across all legs—either the full transaction posts, or nothing does.

Updated 10 days ago